Property Assessments

Property assessments for the 2025 property tax year will continue to be based on January 1, 2016, current values. This means your assessment for 2025 will remain the same unless there have been changes to your property.

Want to learn more?

We encourage you to visit AboutMyProperty.ca to learn more about how your property was assessed, see the information MPAC has on file, as well as compare it to others in your neighbourhood.

Request for Reconsideration

If you disagree with your property's assessed value and/or classification, you have the option to file a Request for Reconsideration with the Municipal Property Assessment Corporation (MPAC). The deadline to submit a Request for Reconsideration for each taxation year is printed on your Property Assessment Notice. For more information, please visit the MPAC Request for Reconsideration website.

Final Tax bills are calculated based upon the assessment provided to Clarington by MPAC in December of the previous year. Any adjustments to the current year assessments will be completed after Final Tax bills are issued. Adjustment letters will be mailed separately. Until adjustments are completed on your account, the amounts billed should be paid by the due date to avoid penalties. Credit adjustments will be first applied to any balance owing on the property or refunded if the account has been paid in full.

Questions?

Do you have questions about your Property Assessment Notice? Visit AboutMyProperty.ca or contact the Municipal Property Assessment Corporation (MPAC) Customer Contact Centre at 1-866-296-MPAC (6722), or 1-877-889-MPAC (6722).

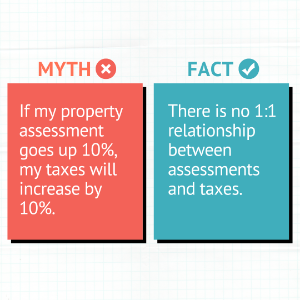

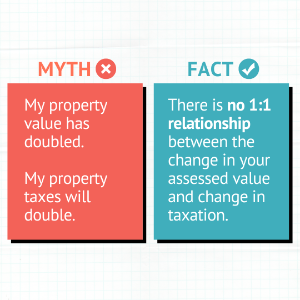

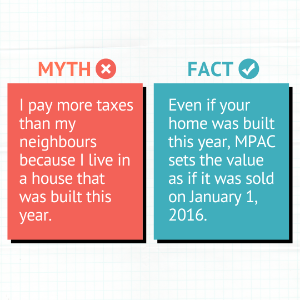

MPAC’s Myth vs Fact

A common misconception is that a significant change in a property’s assessed value will result in a proportionately significant change in the owner’s property taxes. However, the most important factor is not how much the assessed value has changed, but how much the assessed value has changed relative to the average change for the same property type in the municipality.

Tax implications for individual property owners vary depending on how their property relates to others around them. When a province-wide assessment takes place and your property assessment increases, it does not automatically equate to an increase in your property taxes.

Municipalities decide what services they will provide in their communities and calculate how much they will cost each year. Municipalities collect property taxes to help pay for these services. MPAC's property assessments help governments calculate each property owner’s share of the overall cost.

MPAC’s property assessments are based on a single valuation date for the entire province -- where all properties are assigned a value as if they sold on the same date. The date, determined by the province of Ontario, ensures consistency for every community, so all municipalities start at the same point for budget decisions such as property tax rates.

Learn more

- First-time Homeowners' Hub

- How your property taxes are calculated (Video)

- How to read your Property Assessment Notice (Video)

- What do MPAC Property Inspectors look for? (Video)

- How sales affect your assessment (Video)

For more information regarding the assessed value of your home, visit the Municipal Property Assessment Corporation (MPAC) website.

Contact Us

Address: 40 Temperance Street, Bowmanville, ON L1C 3A6

Phone: 905-623-3379

TTY: 1-844-790-1599