Residents pay property taxes to cover the cost of services provided by the Municipality. The tax levy is the dollar amount that you pay for Municipal services. It's the amount of money the Municipality needs to provide services, including snow clearing, road repair, emergency services, parks maintenance, libraries, just to name a few.

Each budget year, the Municipality determines how much money is needed to maintain our services and provide any service enhancements. That cost is added up and divided by the total assessed value of all properties across the Municipality. The Municipal Property Assessment Corporation (MPAC) assesses all homes and properties across Ontario. MPAC determines what your home is worth. The tax rate is calculated by taking the cost of providing services and dividing it by the total assessed value of all homes and properties across the Municipality.

The tax rate is split into three:

- The Municipal tax rate set by the Municipality of Clarington.

- The Regional tax rate set by the Regional Municipality of Durham.

- The Education tax rate set by the Province of Ontario.

The municipal tax rate is determined after Clarington Council, and the Region of Durham approve their budgets, and the Province of Ontario establishes the education rate.

The tax rate varies depending on the type of property. The main property classes include residential, multi-residential, commercial and industrial. You can view property tax rates broken down by the type of property.

Our applications and forms section contains your tax payment options, mailing address change and other helpful information.

| Adjustments | ||||||||||||||||||||||||||||

Ontario Senior Homeowners' Property Tax GrantThe Ontario Senior Homeowners' Property Tax Grant is an annual amount provided to help offset property taxes for seniors with low and moderate incomes who own their homes. Senior homeowners can apply for the grant when they file their personal income tax return. For more information, contact the Ministry of Finance or call 1-800-337-7222. Cancellation or reduction of taxesThe Municipality of Clarington accepts applications to cancel or reduce property taxes in certain circumstances:

If you believe you qualify for a cancellation or reduction of your taxes, submit the form below by the last day of February of the year following the year of the application. Application for Cancellation/Reduction/Refund of Taxes Final Tax bills are calculated based upon the assessment provided to Clarington by MPAC in December of the previous year. Any adjustments to the current year assessments will be completed after Final Tax bills are issued. Adjustment letters will be mailed separately. Until adjustments are completed on your account, the amounts billed should be paid by the due date to avoid penalties. Credit adjustments will be first applied to any balance owing on the property or refunded if the account has been paid in full. Charity rebatesEligible charities may receive a rebate of the taxes on the building or portion of the building they occupy. The application must be submitted by the last day of February of the year following the year of the rebate. Application for Property Tax Rebate for Registered Charities |

||||||||||||||||||||||||||||

| Applications and Forms | ||||||||||||||||||||||||||||

Application formsWe have included a list of various forms you may need for tax and other purposes.

Roll number look-upFor some forms, including the Tax Certificate online tool and eBilling forms, you will need your Assessment Roll Number. Use our Property Search Map to find your Assessment Roll number by entering your address into the search bar and scrolling through the property details. Pre-authorized payment plan forms

Payment arrangement for outstanding property taxesIf you have outstanding property taxes and want to submit a request for a payment arrangement, please fill out the application form below: Changing your school support |

||||||||||||||||||||||||||||

| Change of Home Ownership | ||||||||||||||||||||||||||||

|

A $40 administration fee per roll number applies for change of home ownership requests. The Municipality of Clarington will mail a tax bill to the property owner on record at the time the tax bills are issued. When you buy a home, check with your lawyer or contact Taxation Services to confirm when the next payment is due on your property taxes. Penalty/interest charges will apply on late payments regardless of any change in ownership. A copy of the transfer/deed is required to process a change of ownership. If you receive a tax bill for a property you no longer own, please contact Taxation Services at 905-623-3379 ext. 2650. |

||||||||||||||||||||||||||||

| Fees for Service | ||||||||||||||||||||||||||||

| See our Fee By-law for property tax service fees. | ||||||||||||||||||||||||||||

| Instalment Due Dates | ||||||||||||||||||||||||||||

|

Property tax bills are issued twice each year. Each tax bill contains two instalments for a total of four payments a year. All property tax classes will have the same instalment due dates. There will no longer be separate instalment dates for Residential and Commercial / Industrial properties.

Property owners enrolled in our monthly pre-authorized payment plan will receive only a final tax bill each year. Your final tax bill will state any changes to your monthly withdrawal amount, and provide your December 1 withdrawal amount for the upcoming year. Property owners who have a mortgage company making payment on their behalf will receive only a final tax bill each year. Supplementary due datesSupplementary tax bills, which represent additional assessment on your property determined by the Municipal Property Assessment Corporation (MPAC), are sent out monthly from July to November. Instalment due dates will vary depending on the date of issue. A minimum of 21 days notice will be provided before the first instalment is due. The Assessment Act gives MPAC authority to correct any missed assessment for the current year plus up to two years prior. Homeowners will receive notification directly from MPAC before receiving tax information from the Municipality.

|

||||||||||||||||||||||||||||

| Lawyer Information | ||||||||||||||||||||||||||||

Tax certificatesA tax certificate is a legal document typically purchased by lawyers or financial institutions that shows the annual taxes and any current or prior year arrears on a given property. Property tax certificates are now available online through the Tax Certificate Online Tool (TCOL), made available in collaboration with Dye & Durham and Access Point Information Canada. TCOL is a fast, convenient way to obtain tax certificates electronically within minutes. Roll number look-upIn order to request your tax certificate, you will need your Assessment Roll Number. Use our Property Search Map to find your Assessment Roll number by entering your address into the search bar and scrolling through the property details. Verbal tax informationStaff cannot provide verbal information for new tax certificate requests. Verbal updates will only be provided up to 90 days from the date the tax certificate was issued. If you require additional information after 90 days, you must purchase a new tax certificate. Transfer deedsTransfer deeds are necessary to process a change of ownership. Please send by email to tax@clarington.net or fax to 905-623-4169. |

||||||||||||||||||||||||||||

| Newly Constructed Homes | ||||||||||||||||||||||||||||

|

Property owners of newly constructed homes will receive a tax bill for the value of the vacant lot only until the home is assessed by the Municipal Property Assessment Corporation (MPAC). A supplementary tax bill will then be issued for taxes on the value of the house only. This process can take up to two years, and the tax bills will be retroactive to the date that you purchased the home. You may receive multiple bills, one for each year since the purchase date. To plan for these supplementary tax bills, please contact Taxation Services to help you calculate the estimated value based on the purchase price of your home. Alternatively, you can sign up for the pre-authorized payment plan to have payments automatically deducted from your bank account. |

||||||||||||||||||||||||||||

|

Payment Options |

||||||||||||||||||||||||||||

|

The Municipality of Clarington offers many convenient ways for you to pay your property taxes, including online, by phone, by mail, in person, at your bank or by pre-authorized payment. See details about each payment method below.

If you don't receive a tax noticeFailure to receive a tax notice does not eliminate the responsibility for the payment of taxes and penalties. If you are responsible for paying property taxes and do not receive a notice, please contact Taxation Services at 905-623-3379 ext. 2650 |

||||||||||||||||||||||||||||

| Property Assessments | ||||||||||||||||||||||||||||

|

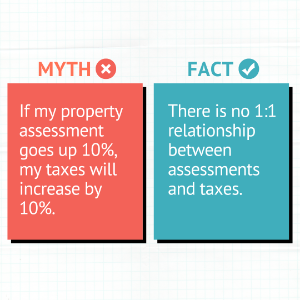

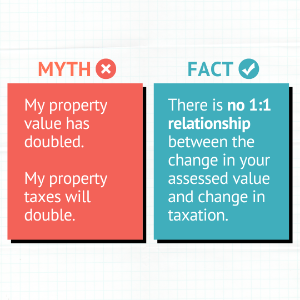

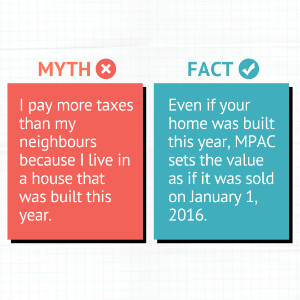

Property assessments for the 2024 property tax year will continue to be based on January 1, 2016, current values. This means your assessment for 2024 will remain the same unless there have been changes to your property. Want to learn more?We encourage you to visit AboutMyProperty.ca to learn more about how your property was assessed, see the information MPAC has on file, as well as compare it to others in your neighbourhood. Request for ReconsiderationIf you disagree with your property's assessed value and/or classification, you have the option to file a Request for Reconsideration with the Municipal Property Assessment Corporation (MPAC). The deadline to submit a Request for Reconsideration for each taxation year is printed on your Property Assessment Notice. For more information, please visit the MPAC Request for Reconsideration website. Final Tax bills are calculated based upon the assessment provided to Clarington by MPAC in December of the previous year. Any adjustments to the current year assessments will be completed after Final Tax bills are issued. Adjustment letters will be mailed separately. Until adjustments are completed on your account, the amounts billed should be paid by the due date to avoid penalties. Credit adjustments will be first applied to any balance owing on the property or refunded if the account has been paid in full. Questions?Do you have questions about your Property Assessment Notice? Visit AboutMyProperty.ca or contact the Municipal Property Assessment Corporation (MPAC) Customer Contact Centre at 1-866-296-MPAC (6722), or 1-877-889-MPAC (6722). MPAC’s Myth vs FactA common misconception is that a significant change in a property’s assessed value will result in a proportionately significant change in the owner’s property taxes. However, the most important factor is not how much the assessed value has changed, but how much the assessed value has changed relative to the average change for the same property type in the municipality.

Tax implications for individual property owners vary depending on how their property relates to others around them. When a province-wide assessment takes place and your property assessment increases, it does not automatically equate to an increase in your property taxes.

Municipalities decide what services they will provide in their communities and calculate how much they will cost each year. Municipalities collect property taxes to help pay for these services. MPAC's property assessments help governments calculate each property owner’s share of the overall cost.

MPAC’s property assessments are based on a single valuation date for the entire province -- where all properties are assigned a value as if they sold on the same date. The date, determined by the province of Ontario, ensures consistency for every community, so all municipalities start at the same point for budget decisions such as property tax rates. Learn more

For more information regarding the assessed value of your home, visit the Municipal Property Assessment Corporation (MPAC) website.

|

||||||||||||||||||||||||||||

| Property Tax Rates | ||||||||||||||||||||||||||||

|

The following table shows the combined 2025 tax rate for properties in Clarington:

Property taxes are calculated by multiplying this percentage with your current value assessment. For example, the property owner of a residential home assessed at $402,507 would pay $5,494.30 in property tax in 2025. Final tax rates by year

Municipal Tax Clawback/Capping RatesThere are no 2022 capping adjustments. The Region of Durham has fully exited the capping program. |

||||||||||||||||||||||||||||

| Understanding Your Tax Bill | ||||||||||||||||||||||||||||

|

Taxes are calculated based on your property assessment and the tax rates that apply. The assessed value of your property is determined by the Municipal Property Assessment Corporation (MPAC). All properties in Ontario are assessed and taxed based on a market value as of January 1, 2016. New notice of assessments were mailed to each property owner June 20, 2016 for assessed values as of January 1, 2016. The Province has announced the decision to postpone a province-wide property assessment update due to the pandemic. Property assessments for the 2024 property tax year will continue to be based on January 1, 2016 current values. This means your assessment for 2024 will remain the same, unless there have been changes to your property. If you have questions about your assessment, please contact MPAC at 1-866-296-6722 or visit the MPAC website. Who determines the tax rates?

Example of an average tax billFor the 2025 tax year, the average assessed value for a home in Clarington is $402,507. Your Clarington tax rate is: 0.467151% Total 2025 taxes: $402,507 x 1.365020% = $5,494.30 Of which:

Compare taxes across Durham RegionHomeowners pay taxes based on how much their house is worth. A lower tax rate does not equal lower property tax. View our infographic to learn more. Have you thought about how your taxes are allocated? How much money goes to pay for roads, schools, waste collection and much more? Clarington is part of a two-tier Government. The Region of Durham forms the upper tier, while Clarington is one of eight lower tier Municipalities within the Region. The Region of Durham is responsible for key services that residents rely on, including water, sewer, regional roads, social services, social housing, and garbage collection. Lower tier Municipalities, like Clarington, are responsible for maintaining infrastructure such as Municipal roads and bridges. Clarington also looks after parks, recreation facilities, fire services, winter road maintenance, Municipal law enforcement, libraries, tourism and much more. As a result, your tax bill is split into three separate portions: approximately half of it, or 50 per cent, goes to pay for services provided by the Regional Municipality of Durham; 33 per cent goes to pay for services that Clarington provides; while 17 per cent is allocated to local School Boards for education.

Property tax breakdown calculatorDownload the property tax breakdown calculator (XLSX) to see how your tax levy is spent. Simply enter your property assessment value and select your assessment class (e.g. residential) to see the breakdown based on 2025 property tax values. Read more on our Budgets, Financial Statements and Reports page. |

Contact Us

Pay your property taxes by credit card, Interac e-transfer, in-person at a post office using cash or debit, and PayPal, all through PaySimply.ca.

Pay your property taxes by credit card, Interac e-transfer, in-person at a post office using cash or debit, and PayPal, all through PaySimply.ca.